State Essential Services Assessment (SESA) Exemption and State Essential Services Incentive Programs

The State Essential Services Assessment is required for manufacturers that do not pay personal property tax on eligible manufacturing personal property. The MSF, in certain circumstances, may choose to exempt or reduce the Assessment for projects that create jobs and/or private investment in Michigan through the State Essential Services Assessment (SESA) Exemption or the Alternative State Essential Services Assessment Incentive.Overview

The State Essential Services Assessment is required for manufacturers that do not pay personal property tax on eligible manufacturing personal property. The MSF, in certain circumstances, may choose to exempt or reduce the Assessment for projects that create jobs and/or private investment in Michigan through the State Essential Services Assessment (SESA) Exemption or the Alternative State Essential Services Assessment Incentive.

Eligibilty

State Essential Services Assessment (SESA) Exemption Projects located in eligible distressed areas (EDAs) that result in $25 million or more of qualifying investments in eligible manufacturing personal property may be considered for a State Essential Services Assessment exemption. A list of EDAs can be found here.

Alternative State Essential Services Assessment (SESA) Incentive

Projects that are not located in a distressed area that result in $25 million or more of qualifying investment in eligible manufacturing personal property may be considered for an Alternative SESA if the MSF board determines the project is a transformational project.

Both the SESA Exemption and the Alternative SESA awards are subject to MEDC review and MSF board approval.

Review Criteria

The MSF will consider any or all of the following factors (the “Considerations”) when reviewing a project for

MSF support:

- Out-of-state competition

- Net-positive return to this state

- Level of investment made by the eligible claimant

- Business diversification

- Reuse of existing facilities

- Near-term job creation or significant job retention as a result of the investment made in eligible personal property

- Strong links to Michigan suppliers

Terms

The assessment is applied to eligible manufacturing personal property exempt from personal property tax according to the following schedule:

- Eligible manufacturing personal property acquired 1–5 years prior is assessed 2.4 mills of the acquisition cost

- Eligible manufacturing personal property acquired 6–10 years prior is assessed 1.25 mills of the acquisition cost

- Eligible manufacturing personal property acquired more than 10 years prior is assessed 0.9 mills of the acquisition cost

Process

All projects are subject to an application and due diligence process conducted by the MEDC. Projects that receive MEDC support will require MSF approval and an agreement between the MSF and the company.

Note: The following steps are offered as general guidelines to provide guidance on the typical approval process:

- Application

- Company due diligence

- MSF approval

- Agreement between the MSF and company

- Milestones

- Reporting and compliance

SESA Exemption

The SESA exemptions are equal to 100 percent exemption of the SESA for a period of years, up to 15 years. Terms will be determined by a formal review of the considerations.

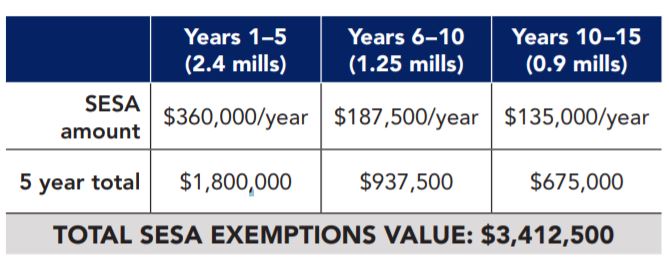

Example: SESA Exemption

$150 million investment in personal property in an eligible distressed area could receive a SESA Exemption for up to 15 years. As a result, the SESA Exemption would be worth:

Alternative SESA incentive

Alternative SESAs are equal to a 50 percent exemption for a period of years, up to 15 years. Terms will be determined by a formal review of the considerations.

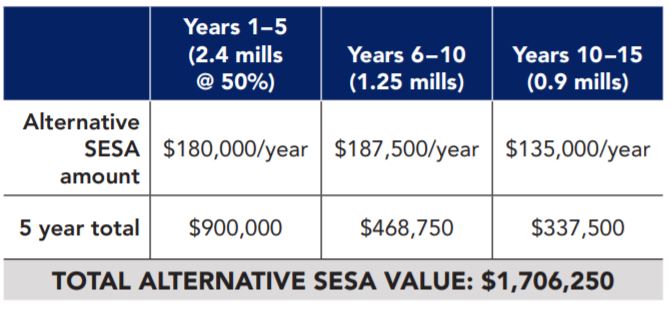

Example: Alternative SESA

$150 million investment in personal property, not in an eligible distressed area, could receive an alternative SESA for up to 15 years. As a result, the alternative SESA would be worth:

Fee

In order to support its reasonable costs and expenses in administering the program, the MEDC has established an administration fee. The administration fee will be 1 percent of the estimated exemption value. The administration fee will be capped at $10,000 and due in full upon successful completion of the first performance milestone.

MEDC is Here and Ready to Help

When it comes to your business, we’re always open. Give us a call to learn more about the State Essential Services Assessment Exemption and Alternative State Essential Services Incentive Programs.

Contact MEDC