$4.7 million in additional loans made to 71 businesses through MEDC Michigan Small Business Relief Program

Friday, September 11, 2020

• New awards bring total of loans to $9 million, along with $10 million in grants already awarded through the program • Low-interest loans intended to support businesses facing drastic reductions in cash flow and the continued support of their workforce in the face of COVID-19 pandemic • Nearly 1,000 additional jobs retained for Michigan workers

LANSING, Mich. – The Michigan Economic Development Corporation announced today it has awarded an additional $4.7 million in low-interest loans to 71 small businesses in 15 counties across Michigan through the Michigan Small Business Relief Program. Today’s support builds on $4.35 million in loans awarded to 74 businesses through the program in June. To date, a total of 2,879 small businesses around Michigan have been awarded nearly $20 million in relief grants and loans through the program to assist with COVID-19 recovery efforts.

“As we continue to focus on restoring economic prosperity for all Michiganders, these loans provide critical support the small businesses throughout the state that are working to recover from the short and long-term impacts of the COVID-19 outbreak,” said MEDC CEO Mark A. Burton. “By collaborating with our local economic development partners, we can deliver vital financial resources to small businesses across Michigan to create a path for economic recovery here in our state.”

The Michigan Small Business Relief Program was authorized by the Michigan Strategic Fund in March of this year to provide relief for small businesses negatively impacted by the COVID-19 crisis. Loans through the program are intended to support small businesses facing drastic reductions in cash flow and the continued support of their workforce and may be used for working capital to support payroll expenses, rent, mortgage payments, utility expenses, or other similar expenses that occur in the ordinary course of business. The full list of businesses receiving support through the Michigan Small Business Relief Program is available here.

Dome Sports Center in Schoolcraft was awarded a $50,000 MSBRP loan through Southwest Michigan First and the funds have helped put the company in a much more stable position to take care of its mortgage, payroll obligations, and other expenses, according to Co-Owner and Director Judd Hoff.

“Closing our indoor operations put us in an unprecedented economic situation. With cash flow essentially gone, paying our mortgage, employees and other contractors was at risk. The MEDC loan couldn’t have come at a better time,” Hoff said. “We were able to bridge the months it took to reorganize our business to meet the demands of our customers in a COVID environment. We successfully responded and our business continues to thrive. The MEDC loan coupled with the PPP loan made this possible.”

Today’s loans were referred by the remaining six of the 15 local economic development organization partners selected to administer the Michigan Small Business Relief Program; the loans referred through the other eight EDOs were announced in June. EDO partners have referred eligible loan applicants to MEDC, where they are reviewed by a loan review committee including the Chief Business Development Officer, Senior Vice President of Growth and Development, and Senior Vice President of Business Development Projects. All loans made through the Michigan Small Business Relief Program are also approved through Michigan Strategic Fund delegated authority.

“This year the Frankenmuth Cheese Haus celebrated 50 years in business and just last fall, opened a beautiful new facility. The COVID-related shutdown was a difficult blow and even after reopening we are at a limited capacity,” said Judy Zehnder Keller, owner of the Frankenmuth Cheese Haus. “We greatly appreciate the MEDC and the relief programs that have supported our business and employees. By working together, we will get through this and the Cheese Haus looks forward to another 50 years.”

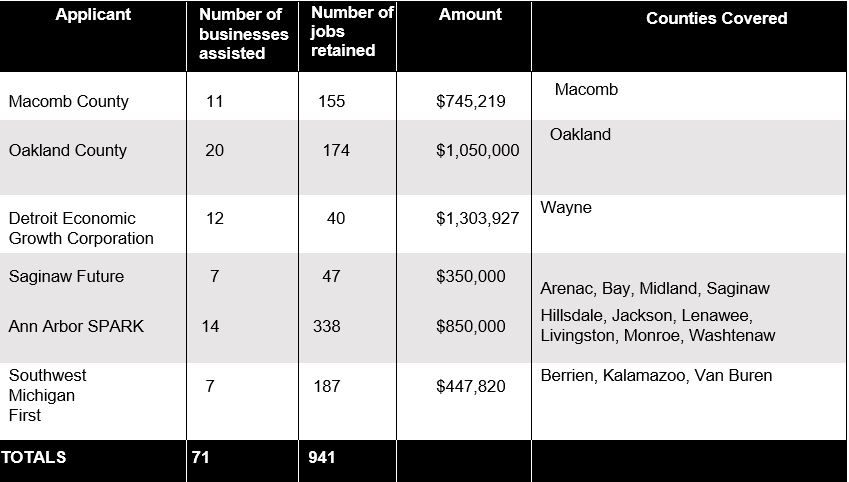

Summary of loans allocated by local economic development organizations:

In addition to the $10 million in loan funds, the Michigan Strategic Fund also approved $10 million in Michigan Small Business Relief Program grants which were administered by 15 local and nonprofit economic development organizations (EDOs) around Michigan. The EDOs were selected through a competitive process based on capacity to administer the program and ensure coverage to small businesses in all 83 counties in Michigan. To see the full list of businesses that received MSBRP grants, visit www.michiganbusiness.org/msbrp.

These relief programs also served as the model for the Michigan Small Business Restart Grant program, authorized by the Michigan Strategic Fund in July. That program, also administered by these 15 local EDO partners, utilized $100 million in federal CARES Act funding to support the needs of Michigan businesses and nonprofits of 50 employees or less directly impacted by COVID-19. The first round of recipients through that program will be announced in the next few weeks.

To date, the MEDC has launched 19 COVID-19 relief and recovery programs expected to support up to 10,000 businesses in the state and helping to retain more than 15,400 jobs across all 83 counties. To learn more about MEDC’s COVID-19 response programs and the impact they are having on economic recovery efforts, visit michiganbusiness.org/covid19response. Other resources for economic reopening efforts as well as businesses across Michigan struggling with economic losses as a result of the COVID-19 virus can be found online at michiganbusiness.org/covid19.

Quotes from local partners

Ann Arbor SPARK

“Small businesses throughout the nation continue to be affected by the COVID-19 crisis; small businesses, including those in our region, are the backbone of our economy,” said Paul Krutko, president and CEO of Ann Arbor SPARK. “We were humbled to do our small part to provide them with financial assistance from the state, and continue to ask businesses to let the legislature know what additional actions they need to weather today’s unprecedented challenges.”

Detroit Economic Growth Corporation

“The Michigan Small Business Relief program is helping Detroit businesses remain open, adapt and grow during these uncertain economic times,” said DEGC Vice President Pierre Batton. “Several of our Detroit small businesses are using COVID relief funding to digitize, scale, hire back employees and adhere to health and safety protocols. This program provides a lifeline for Detroit small businesses, which are the backbone of our economy.”

Macomb County

“We are pleased that Macomb County businesses were selected to take advantage of the MEDC Small Business Relief Loan,” said Macomb County Director Department of Planning and Economic Development Vicky Rad. “This loan provides financial relief above and beyond the businesses losses they have incurred and helps get them back on track.”

Saginaw Future

“Our organization is proud to be a part of a collaborative that assisted seven regional businesses with loans from the Michigan Small Business Relief Program,” said Saginaw Future President JoAnn Crary. “Thanks to the MEDC for initiating this program and so many others that support and sustain our small businesses.”

Southwest Michigan First

“The pandemic has intensified the importance of jobs to local economies, peoples’ livelihoods and their sense of well-being. Only by protecting our small businesses can we ensure the ability of all to grow and prosper,” said Ron Kitchens, chief executive officer and senior partner of Southwest Michigan First. “The State of Michigan and Michigan Economic Development Corporation have done an excellent job of developing a suite of financial assistance options, like Michigan Small Business Relief Loans, to keep the doors of small businesses open. Thank you for your continuing support of businesses in Southwest Michigan.”

About Michigan Economic Development Corporation (MEDC)

The Michigan Economic Development Corporation is the state’s marketing arm and lead advocate for business development, job awareness and community development with the focus on growing Michigan’s economy. For more information on the MEDC and our initiatives, visit www.MichiganBusiness.org. For Pure Michigan® tourism information, your trip begins at www.michigan.org. Join the conversation on: Facebook Instagram LinkedIn, and Twitter.

Recent Press Releases